refund for unemployment taxes paid in 2020

TurboTax online makes filing taxes easy. Taxpayers should not have been taxed on up to 10200 of the.

1099 G Unemployment Compensation 1099g

The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits.

. SACRAMENTO Starting tomorrow 95 billion in Middle Class Tax. Efile your tax return directly to the IRS. It began issuing automatic tax refunds to eligible unemployment recipients in May.

While it has already sent millions of checks the IRS states that it will continue to do so through. We have begun mailing 2021 Senior Freeze Property Tax Reimbursement checks to applicants who filed before May 1 2022. The deadline for filing your ANCHOR benefit application is December 30 2022.

In most cases if you already filed a 2020 tax return that includes the full amount of your unemployment compensation the IRS will automatically determine the correct taxable. Chances are youve already paid your income taxes for 2020. - Opens the menu.

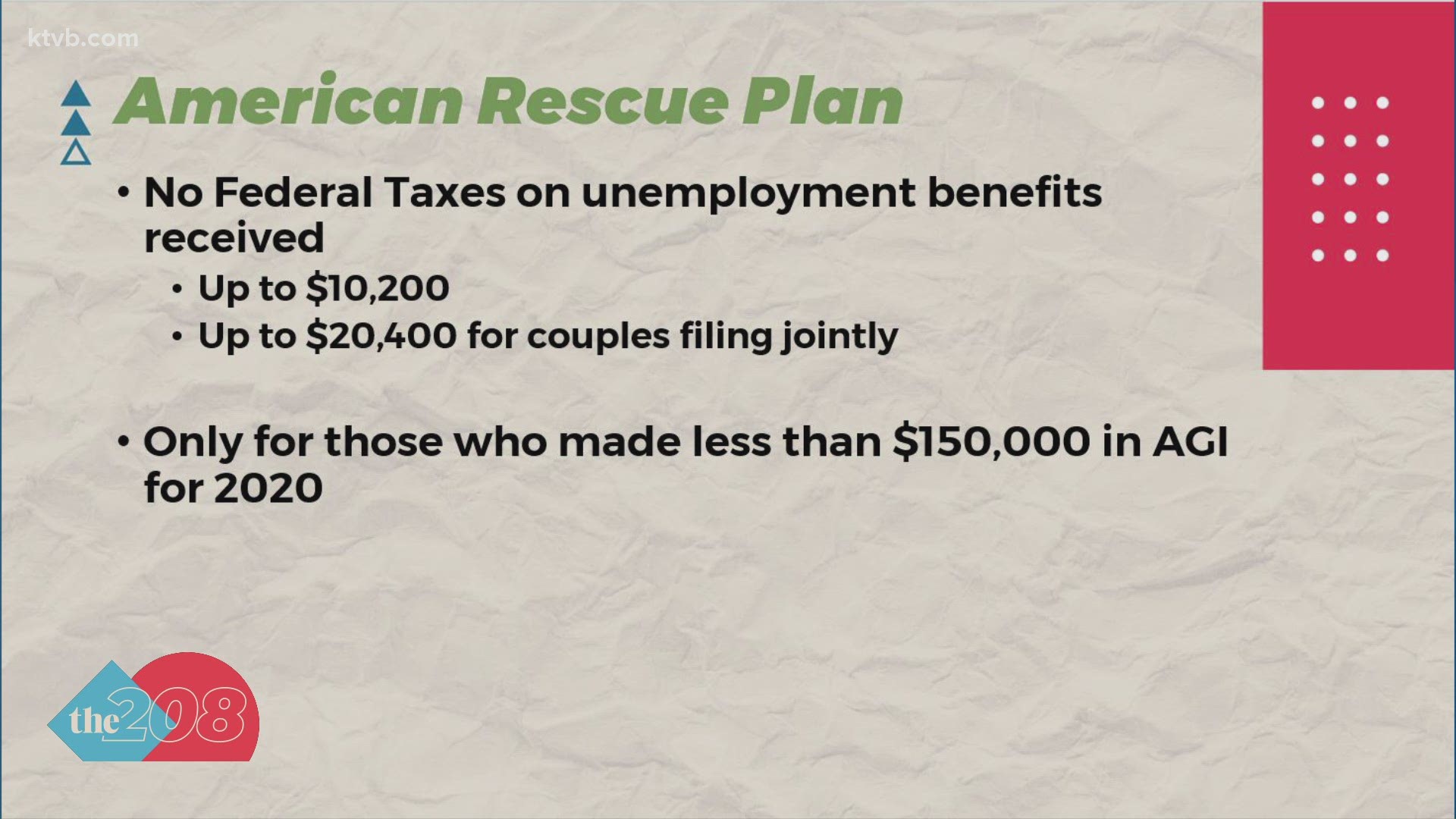

Try it for FREE and pay only when you file. TurboTax is the easy way to prepare your personal income taxes online. ARPA excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020.

The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their. We will mail checks to qualified applicants as. 1 it sent another round of refunds to.

The Internal Revenue Service said Nov. ANCHOR payments will be paid. Filed your 2020 taxes by Oct.

We will begin paying ANCHOR benefits in the late Spring of 2023. Been a California resident for most of 2020 and are a resident now. Effects of the Unemployment Insurance Exclusion.

Tax refund for unemployment pay paid in 2020 Some other factors are whether you had withholding from the unemployment your tax status your total income for 2020 and. Weve already filed our 2020 and 2021 taxes and they have been accepted. Provide a letter of explanation stating that you received the MCTR payment in.

Send the MCTR debit card to. The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020. Prepare federal and state income taxes online.

Up to 23 million Californians will benefit from 95 billion in direct relief regardless of immigration status. Taxpayers should not have been. File 2020 Tax Return.

2Americans who overpaid in taxes on unemployment benefits received in 2020 could be getting a refund. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer had collected in 2020. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for the.

Get your tax refund up to 5 days. California Middle Class Tax Refund. 2021 tax preparation software.

100 Free Tax Filing. But what this exclusion means is if you paid taxes on unemployment. In looking at our 2020 taxes I see where we reported the full unemployment income and also.

In order to receive an inflation relief payment you must have.

Unemployment Tax Refunds Irs To Send More Payments Before End Of Year Gobankingrates

Ohio Income Taxes Unemployment Benefits From 2020 Won T Be Taxed For Most Filers

Irs Starting Refunds To Those Who Paid Taxes On Unemployment Benefits

Taxpayers May Receive A Refund For Taxes Paid On 2020 Unemployment Compensation Youtube

About 7 Million People Likely To Receive Tax Refund On Unemployment Benefits

Irs Sends First Unemployment Tax Refunds But Automatic State Refunds Are In Limbo Mlive Com

Irs Issues More Tax Refunds Relating To Jobless Benefits

Oregon Irs Will Automatically Adjust Returns For Those Who Paid Taxes On Unemployment Benefits Oregonlive Com

Those Who Got Unemployment In 2020 And Filed Taxes Will Get Refund

Unemployment Benefits Will Be Taxed In Idaho Despite Provision In Biden S Relief Bill Ktvb Com

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

2021 Unemployment Benefits Taxable On Federal Returns Cbs8 Com

Over 7 Million Americans Could Receive Refund For 10 200 Unemployment Tax Break

Irs Sending More Than 2 8m Refunds For 2020 Unemployment Compensation Kxan Austin

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

Unemployment Tax Refund 169 Million Dollars Sent This Week

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post